Death Of The Small Eurobusiness, In A Bank Screenshot

Falkvinge on Infopolicy 2013-03-29

Transparency: With banks opening on Cyprus, many entrepreneurs realized they had been wrecked overnight by their government’s dishonesty. The so-called bank bailout was in reality a death sentence for many small businesses, who saw their operating capital confiscated to save the government’s face. This move will create an inevitable uncertainty throughout the Eurozone: who will dare put their operating capital in a bank in a troubled country, when politicians keep saying everything is fine – until one day, the money is just gone?

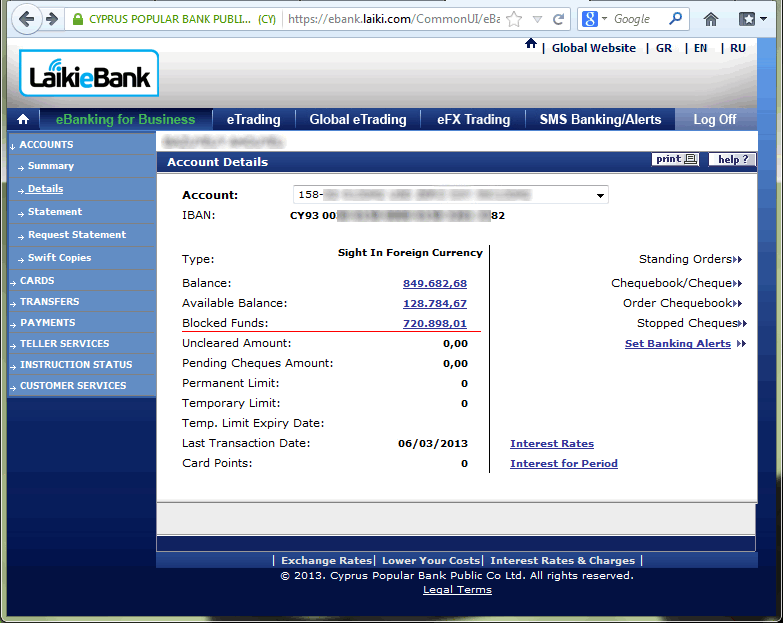

In a post this morning in the Bitcoin forums, user zeroday complains that 700,000 Euros were robbed by the European Commission. They’re not some Russian oligarch, the user writes, but a typical medium-size European IT business, and the result of this is that the entire Cypriot workforce will have to be laid off. The screenshot from the bank speaks a thousand words:

Bank screenshot from the Cyprus-based European IT company. The entire operating capital is practically gone overnight, confiscated to save the government’s face.

Thousands of other companies based in Cyprus are in the same situation, zeroday writes. This is not just problematic, but catastrophic on so many levels.

First, the ability for a troubled government to just go in and take money wherever it damn well pleases goes counter to pretty much every crucial principle of law – that laws need to be predictable, equal, proportional, and its rules known in advance. In this case, neither applied.

Second, the problem here isn’t so much that somebody who invests in a troubled bank goes bust with the bank. That wouldn’t be a problem in itself. The problem is that this happens despite governmental guarantees to the contrary. If governments published bank data openly so every small business in the Eurozone would be able to judge the solvency of their banking partner and make proper risk assessments, this would be proper, and it would be tough but just if a bank went insolvent and its accounts were closed to cover the losses.

But governments keep insisting that this is never going to happen, until it just did. Then, governments go back into denial mode that it will never happen again, with a “would I lie to you twice?” face plastered on, expecting to be believed.

This sends a very clear message to small Eurobusinesses across all of Europe: “governments cannot be trusted when guaranteeing your money in the bank, and you may be next if you keep trusting European governments”. In particular, I expect small businesses in Spain, Portugal, Ireland, Greece, Italy, and France to start relocating their operating capital out of the Eurozone, come the very first weekday after Easter.

Zeroday writes further,

We are moving to small Caribbean country where authorities have more respect for people’s assets. Also, we are thinking about using Bitcoin to pay wages and for payments between our partners.

I expect many, many small Eurozone business to do the exact same thing, after seeing this bank screenshot. Reading about it in the news is one thing. Seeing exactly what happened to this small entrepreneur is another, and realizing that this may be your bank screen tomorrow.

This was the death of the small Eurobusiness climate. At the same time, it was not just the end of the beginning of the Euro, but also the beginning of the endgame.

What we learn from this is that the transparency that would have been necessary at the Euro’s conception is still denied the public at large by banks and governments, and that this lack of transparency brings nothing good at all. Small Eurobusinesses are now dying and not coming back to the Euro, and for very good reason.