Brain scans find signs of financial bubbles

Ars Technica » Scientific Method 2014-07-12

In the financial world, some shares have new owners every second. Today, much of the buying and selling is done by computers, but many trades still rely on human intuition—the gut feeling of the experienced trader.

“Nobody can predict the market, but traders are expected to,” Richard Taffler, professor of finance at the University of Warwick, said. “This creates anxiety.” Anxiety is just one of the emotions that play an important role in driving financial markets. Understanding what happens in the brains of traders as prices move up and down could possibly tell us something about a market’s future developments.

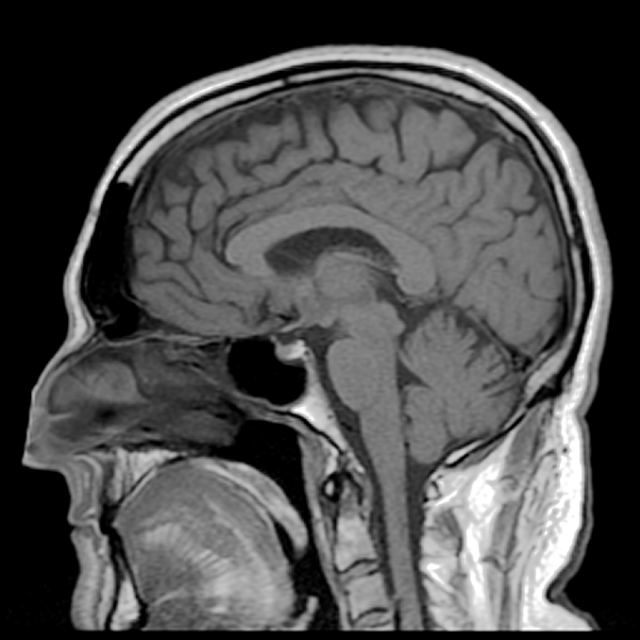

In a study published in the Proceedings of the National Academy of Sciences, Alec Smith at the California Institute of Technology and his colleagues conducted group-behavior experiments. They had between 11 and 23 students play multiple rounds of a game that simulated a market situation. For every round of the game, three of the participants were inside a functional magnetic resonance imaging (fMRI) machine, which identified parts of the brain that have increased or decreased activity during the trading.

Read 11 remaining paragraphs | Comments