For Love and/or Money: Financial Autonomy in Marriage

Messy Matters 2013-04-22

This is a guest post by Bethany Soule with assistance from Daniel Reeves.

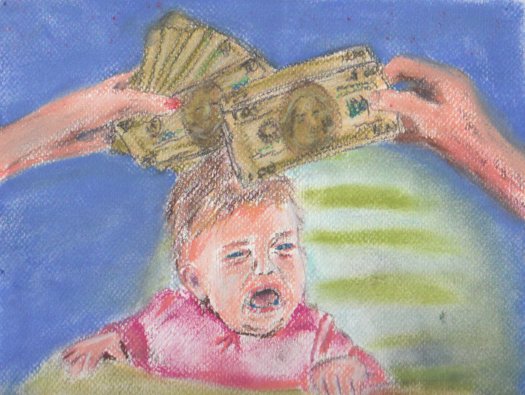

Prescript: We realize how crazy this all sounds! Nonetheless, we’re perfectly serious, and do actually pay each other to put our kids to bed and whatnot. We think we have quite clever mechanisms for deciding who does what and keeping things exquisitely fair, efficient, and resentment-free. And separate finances — i.e., financial autonomy — is a prerequisite. We tried it with our own fiat currency — yootles — and that didn’t work so now we just use dollars. [1]Some of this bears uncomfortable resemblance to the kinds of things two raving Libertarian nutjobs would say. (It’s not like that, baby, we swear it.)Nonetheless, this being the single most demanded article by you, Dear Readers, we are finally caving to the pressure.

Merging all finances upon getting married is still the de facto standard in the modern world.Each contributes according to their ability and takes according to their need. Which is fine. It’s not fundamentally unreasonable for a relationship.Marriage is about becoming a team, becoming life-partners, and, yes, sharing your resources.But we also feel particularly strongly about maintaining autonomy even in a life-long committed relationship.Psychologists will tell you that perceived level of autonomy is a prime predictor of happiness with your life and situation. [2]Partnership and resource sharing may seem at odds with autonomy but I’m here to argue that they need not be!

Danny and I have been married for six years now, and we have two kids and a burgeoning startup that we co-founded.We work literally side by side every day. We fancy ourselves a pretty good team.Being financially autonomous [3] helps us do all that.I should emphasize that none of this has much to do with the fact that we’re business partners in addition to being life partners.We were financially autonomous for years before founding Beeminder — in fact, we always have been, since we never merged finances in the first place.I mention it only as evidence of our commitment and ass-kicking teamwitchery. [4]

Philosophical assumptions

Before we get too far into extolling the benefits of separate finances, let us explain how we operate on some basic shared philosophical assumptions.

- Egalitarianism

- Everyone’s happiness is fundamentally equally important.

- Autonomy

- People are free to make their own choices, their own mistakes, and have their own utility functions.

- Fairness

- Everyone in a team, contributing equally, should share equally in all the rewards of the teamwork.

I get a little giddy when I read that list.Seriously, we named our daughter Faire because we like fairness so much.It’s my litany against being mean.When I start to get het up over some perceived injustice, it almost always goes away when I stop to examine what underlying assumption I’m violating.“I can’t believe you…” oh wait. They’re an autonomous agent. Their happiness is just as important as mine. Stop being such a judgmental Bee!

Furthermore it may be the case that separate finances are a natural consequence of these three principles. If we pooled finances, I would benefit from Danny’s hard work, even when I don’t do anything. That certainly violates fairness. If I use joint resources to buy a banjo, Danny’s resources got allocated in a way that he didn’t choose, violating autonomy, and leaving room (and hours of my practicing) for resentment to build.

Benefits of separating finances

First, we find there is much less stuff to fight about.We’ve eliminated a wide array of guilt trips and I-always-and-you-never!-s from even being possible. There’s no arguing over how you spent our money.And if you are complaining about how your spouse is spending their own money, assuming it is not dangerous or self-destructive, excuse me but you’re being kind of a jerk. You’re probably either questioning the correctness of their utility function, or you’re just devaluing their happiness.

Aside from making it much harder to fight about money, thinking of your partner as an autonomous agent is a great innoculation against any sort of argument that starts with “but you should have…”You stop making assumptions about their utility, their thoughts, their emotions, and you do a lot more active communicating and wind up frustrated and disappointed much less.

Second, with separate money we’ve got a whole new class of conflict resolution.We still debate, negotiate, argue, and occasionally even plead (OK rarely; if you’ve hit pleading you should probably move on to a different resolution mechanism).But any decision has a fallback resolution method as definitive as voting would be if there were an odd number of us.That’s right, we use auction-based decision-making in our family.Where’s my nerdcrown?

Third, since my money is my own money, if I pay Danny it is actually meaningful.Transferable utility is pretty exciting!It means that any outcome can be made fair after the fact.You know, by paying each other.Without financial autonomy, conflict resolution often winds up at compromise (nobody is happy), or sacrifice (one person gets all the happy). By paying each other we’ve opened up a whole middle ground of less bad outcomes!For example, let one person have their way, but then transfer half their surplus utility to the person who lost out.

“All preferences are quantifiable in terms of money. If you think like an economist (and do we ever), that is obvious to you.”

Of course, these second two benefits rely on the assumption that all preferences are quantifiable in terms of money. If you think like an economist (and do we ever), that is obvious to you.But if you have never practiced quantifying your preferences before, it might seem impossible to put a price on, e.g., making sure your kid gets registered for school.It is true that coming up with valuations for nebulous things is hard and can sometimes seem arbitrary.However you can improve with practice, and we even have an exercise [5] utilizing binary search to help you home in on a reasonable value.Sometimes trying to quantify your preferences is little better than pure randomization, but it is still slightly better than actually flipping a coin.Plus, afterwards you make a payment to help the loser feel better.The more important the decision, the better idea you have how much you care, and the less like a coin flip it is. The closer your utilities are or the more arbitrary your assignment of utility, the more like a coin flip it is, but the less egregious that is.

Mechanisms for decision making and resolution of conflicts

The most general form of decision auction that we use works like this:

There are n participants, each with some share — i.e., some fraction — of a decision. Everyone submits a sealed bid, the second highest of which is taken to be the Fair Market Price (FMP). The high bidder wins, and buys out everyone else’s shares, i.e., pays them the appropriate fraction of the FMP.

We’re usually in the special case of two players and 50/50 shares and we call that case “even yootling” or just “yootling”, in reference to our ill-fated currency, the yootle.It works like this:Each person simultaneously states how much they’d pay. [6]The person with the higher number wins and pays the loser the loser’s bid.

We may do this multiple times per day, whenever there’s a good that we have shared ownership of and one of us wants to offload their shares onto the other person. The goods can be anything, e.g. the last brownie, but they’re more often “bads” like who will get up in the middle of the night with a vomiting child, or who will book plane tickets for a trip.

As for simultaneously stating bids, we do that by each sticking our hands behind our back and holding up a configuration of fingers to represent / commit us to our number and then we reveal on a count of three. We’re very loose with how we represent numbers with fingers.We might hold up two fingers to represent $20. Or a 1 on one hand and a 3 on the other to represent $13.It wouldn’t really be hard to cheat and make up a new advantageous interpretation of one’s finger configuration upon learning the other’s bid, but we trust each other not to be cheats and jerks.That’s true love, baby. [7]

We find this an elegant means of assigning loathed tasks.The person who minded least winds up doing the chore, but gets compensated for it at a price that by their own estimation was fair.

Bilateral trade and PandA

We almost always use 50/50 yootling to make decisions and allocate shared resources but once in a while we’ll use other kinds of auctions.One variant is the special case of the general decision auction where the shares are 100/0.In other words, plain old bilateral trade: you have something, I want it.If we can agree on a price, the good changes hands, if we can’t, no trade occurs. It’s an insanely useful transaction, and it’s not possible if you share your finances.

To see how it’s a special case of the general decision auction, take the case of me wanting to buy Danny’s old monitor.I say how much I’d pay, Danny says how much he’d sell for, and if we overlap then I buy it at the price he named (the lower price, which, recall, is taken to be the Fair Market Value).If we don’t overlap — if my willingness to buy was lower — then Danny buys my 0 shares for 0% of the Fair Market Price.I.e., nothing happens and he keeps his monitor.

Once in a while the trick with simultaneously revealing our fingers is too cumbersome.In that case we’ll use a mechanism we call PandA — for “Propose and Accept”.In the case of 50/50 shares, it works like this:One person names a price, and the other must choose to either pay the price and get the good (or get out of the chore), or accept the price and relinquish their share of the good (or do the chore). We don’t use this mechanism often, and we’ll leave it as an exercise for the reader whether you should prefer to be the proposer or the accepter. Seriously, this is homework. Get out your mechanical pencils and figure that shit out and tell us in the comments. Points will be awarded.

Besides the easier coordination, an advantage of PandA is that only one person has to pull a price out of thin air. Our squishy human brains are much better at saying yes or no to a given price than deciding how much something is worth, with nothing to anchor on. It can be agonizing to decide how much you care about running an errand, or doing some dishes or whatever. Of course we’ve gotten pretty good at that. [5]

Joint purchase auction

The decision auction and variants are about allocating shared or partially shared resources to one person or the other, or picking one person to do something.Once in a while you have the opposite problem: deciding on a joint purchase.

Suppose Danny thinks we need a new sofa (this is very hypothetical).I think the one we have is just fine thank you. After some discussion I concede that it would be nice to have a sofa that was less doggy.Danny, being terribly excited about getting a new sofa does a bunch of research and finds his ideal sofa. I think it is a bit overpriced considering it is going to be a piece of gymnastics equipment for the kids for the next 6 years.Conflict ensues!I could bluff that I’m not interested in a new sofa at all and that he can buy it himself if he wants it that badly.But he probably doesn’t want it that bad, and I do want it a little.If only we could buy the sofa conditional on our combined utility for it exceeding the cost, and pay in proportion to our utilities to boot.Well, thanks to separate finances and the magic of mechanism design, we can!We submit sealed bids for the sofa and buy it if the sum of our bids is enough.(And, importantly, commit to not buying it for at least a year otherwise.)Any surplus is redistributed in proportion to our bids.For example, if Danny bid $80 and I bid $40 to buy a hundred dollar sofa, then we’d buy it, with Danny chipping in twice as much as me, namely $67 to my $33.

Generosity without sacrificing social efficiency

“The payments are simply what keep us honest in assessing that.”

If you’re thinking “how mercenary all this is!” then, well, I’m unclear how you made it this far into this post. But it’s not nearly as cold as it may sound. We do nice things for each other all the time, and frequently use yootling to make sure it’s socially efficient to do so.Suppose I invite Danny to a sing-along showing of Once More With Feeling (this may or may not be hypothetical) and Danny doesn’t exactly want to go but can see that I have value for his company.He might (quite non-hypothetically) say “I’ll half-accompany you!” by which he means that he’ll yootle me for whether he goes or not.In other words, he magnimously decides to treat his joining me as a 50/50 joint decision.If I have greater value for him coming than he has for not coming, then I’ll pay him to come.But if it’s the other way around, he will pay me to let him off the hook.We don’t actually care much about the payments, though those are necessary for the auction to work.We care about making sure that he comes to the Buffy sing-along if and only if my value for his company exceeds his value for staying home.The payments are simply what keep us honest in assessing that.The increased fairness — the winner sharing their utility with the loser — is icing.

Nitty gritty

That was all extremely high level. You probably want the real dirt. Like do you pay each other for sex? Or are there any legal teeth to our arrangement?No, it’s purely a gentlemen’s agreement.And in fact for whole classes of expenses, including everyday things like groceries, we do very little accounting.We used to split groceries and dinner bills 60/40, reasoning that Danny ate (or should be eating) rather more than me, being the larger one.Actually, rather than splitting the bill 60/40, when grocery shopping or eating out we’d randomize such that Danny would pay the whole bill with 60% probability and I’d pay with 40%.We’ve gotten even lazier and now we just wing it and figure it balances out over time.Or we pay each other stochastically — with 90% probability we pay nothing (and don’t even have to compute the actual transfer amount), and with 10% probability we pay ten times the amount.We wrote an Android app — Expectorant — to make that sort of thing easier.We impressed Andy Brett recently on a trip to Tahoe when I repaid Danny $100 stochastically (i.e., taking a 10% risk of owing him $1000).

For larger recurring expenses we put a repeating transfer on a ledger and forget about it.Rent, for example, we split. You could fix different rent percentages based on salary, and I believe this is what we did in NYC when I was in grad school and Danny was gainfully employed. Alternately, a joint-purchase auction about our housing options should make the socially efficient outcome happen, not least of all by encouraging us to look at our finances and make an informed decision about our utility functions with respect to housing.

Children are a joint expense, obviously. [8]If one partner is a stay-at-home-parent you pay the full-time parent something, possibly half the salary of the parent who works, if you don’t have a fairer principle to apply to pay for the parenting.A more fair principle might be to split the difference between a fair market wage for full time childcare with what they could be making if they were out working instead of staying at home to raise your (their) kids.

The most important thing of course is to come up with a principle that feels fair to both parties. Danny and I have a fun way to debate something like this. We switch sides and each argue for the other’s best interest. The spirit of our agreement is quite loving.We’re a team.We’re actually quite nice to each other.We just recognize that no matter how well we know each other, we don’t know the other’s utility function better than they do, and we shouldn’t presume to.When you make assumptions about someone else’s preferences, you fall into the trap of assuming they’re an extension of yourself, or a piece of the scenery.So let them speak for themselves. Feed your preferences into a decision mechanism, turn the crank, and trust that the optimal outcome comes out.Live the robot-mediated life!

Related Reading

- The Gender of Money

- Housewife Charged In Sex-for-Security Scam

- Five-part series on marital finances in Slate

- Yootopia!

Footnotes

[1]Bitcoins would work fine too. The volatility just makes it hard to establish an intuitive sense of the value of them.In reality we mostly use our own two-node Ripple-like system, which is to say we pass IOUs back and forth on a ledger

[2]In particular I will link you to a study at the University of Wellington, Victoria as well as a survey in Forbes of this and other related research on autonomy (freedom) and happiness.

[3]By “financially autonomous” we mean from each other.Not to be confused with “financially independent”, by which is normally meant “filthy rich”.

[4]Yes, that’s totally a thing.

Also, some lazysearch tells me that the average length of a marriage in the US may be 11 years now. So maybe check back with us in another 3 – 5 years and see if we’re still riding broomsticks.

[5] When you are unsure of your own value for a particular outcome, we find a simple binary search to be effective at pinning down your indifference point. “Would I take that plane ticket if it were free?” “Definitely.” “Would I buy it if it cost $1000?” “No way.” “$500?” “Uhh, No.” “$250?” “Definitely.” “$375?” “Yeah, I guess.” “$438?” “Uhh, well…” The point where you are torn is a pretty good approximation of your true utility.

[6] The amount you’d pay is technically your share (e.g., half) the Fair Market Price (FMP) but when all the shares are the same it doesn’t matter whether the bids are FMP or half of FMP since the comparison will be the same. So with 50/50 shares it’s easier to bid half of FMP since that’s the amount that the winner will pay the loser.

[7]As for why fingers are needed at all, it’s just a way to mentally commit to a bid without being influenced by the other’s bid.

[8]But funny story — Danny actually paid me for the opportunity cost of having my womb tied up with child.He’s sweet like that. Yes, seriously. I was in grad school working on my master’s degree at the time and I reduced my class load to 3/4 time if I recall and so we used that as a metric to calculate roughly what the cost to me was. Then we split the cost evenly because kids are a joint expense. So I guess my womb is worth about the cost of one graduate-level course at Columbia, assuming I’m interested in bearing your kid to begin with.