Economic growth -- vastly slower than we thought (maybe)

The Physics of Finance 2016-02-23

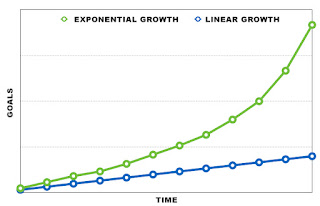

You'd think that by now we'd have a pretty good empirical understanding of how economies grow, i.e. what the normal pattern of growth is through time. We've been studying economies for a couple of centuries, and have had reasonably good numbers of the (crude) measure of GDP for half a century. In economics -- and among the financial media generally -- it's almost beyond question that the normal pattern of economic growth is exponential growth. Indeed, almost no one ever supposes it might be different; we only debate how fast or slow recent exponential growth has been. But we might be wrong, especially for mature economies. That's the conclusion of some recent research by a team of European economists and statisticians who looked at the data on 18 mature economies from 1960 onwards. They find that the best fit to the data isn't exponential at all, but linear, suggesting that if growth was ever exponential (in young economies), it isn't like that any more. I wrote a piece in Bloomberg about this a couple weeks ago. I wasn't aware of this line of work, but apparently a handful of (mostly) German economists have been pointing to this evidence for nearly twenty years. It would hardly be surprising, of course, if human economies -- like individual people themselves, cells, bacterial colonies, trees and anything else alive -- turn out to have natural stages of growth, with fast growth eventually slowing toward something more gradual and, eventually, stopping altogether (which wouldn't imply the end of change, just some kind of balance). Current ideas in economics might need considerable re-thinking, of course. But that wouldn't surprise me either.