Macroeconomics: The illusion of the "learning literature"

The Physics of Finance 2013-12-20

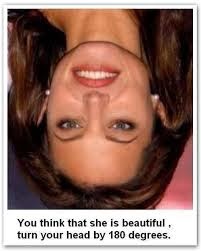

For many economists, prevailing theories of macroeconomics based on the idea of rational expectations (RE) are things of elegance and beauty, somewhat akin to the pretty face you see below. This is especially their view in the light of two decades of research looking at learning as a foundation for macroeconomics -- something economists refer to as the "learning literature." You'll hear it said that these studies have shown that most of the RE conclusions also follow from much more plausible assumptions about how people form expectations and adjust them over time by learning and adapting. Sounds really impressive. As with this apparently pretty face, however, things aren't actually so beautiful and elegant if you take the time to read some of the papers in the learning literature and see what has been done. For example, take this nice review article by Evans and Honkapohja from a few years ago. It is a nice article and reports on interesting research. If you study it, however, you'll find that the "learning" studied in this line of work is not at all what most of us would think of as learning as we know it in the real world. I've written about this before and might as well just quote something I said there:

What the paper does is explore what happens in some of the common rational expectations models if you suppose that agents' expectations aren't formed rationally but rather on the basis of some learning algorithm. The paper shows that learning algorithms of a certain kind lead to the same equilibrium outcome as the rational expectations viewpoint. This IS interesting and seems very impressive. However, I'm not sure it's as interesting as it seems at first. The reason is that the learning algorithm is indeed of a rather special kind. Most of the models studied in the paper, if I understand correctly, suppose that agents in the market already know the right mathematical form they should use to form expectations about prices in the future. All they lack is knowledge of the values of some parameters in the equation. This is a little like assuming that people who start out trying to learn the equations for, say, electricity and magnetism, already know the right form of Maxwell's equations, with all the right space and time derivatives, though they are ignorant of the correct coefficients. The paper shows that, given this assumption in which the form of the expectations equation is already known, agents soon evolve to the correct rational expectations solution. In this sense, rational expectations emerges from adaptive behaviour. I don't find this very convincing as it makes the problem far too easy. More plausible, it seems to me, would be to assume that people start out with not much knowledge at all of how future prices will most likely be linked by inflation to current prices, make guesses with all kinds of crazy ideas, and learn by trial and error. Given the difficulty of this problem, and the lack even among economists themselves of great predictive success, this would seem more reasonable. However, it is also likely to lead to far more complexity in the economy itself, because a broader class of expectations will lead to a broader class of dynamics for future prices. In this sense, the models in this paper assume away any kind of complexity from a diversity of views. To be fair to the authors of the paper, they do spell out their assumptions clearly. They state in fact that they assume that people in their economy form views on likely future prices in the same way modern econometricians do (i.e. using the very same mathematical models). So the gist seems to be that in a world in which all people think like economists and use the equations of modern econometrics to form their expectations, then, even if they start out with some of the coefficients "mis-specified," their ability to learn to use the right coefficients can drive the economy to a rational expectations equilibrium. Does this tell us much?My view is that NO, it doesn't tell us much. It's as if the point of the learning literature hasn't really been to explore what might happen in macroeconomics if people form expectations in psychologically realistic ways, but to see how far one can go in relaxing the assumptions of RE while STILL getting the same conclusions. Of course there's nothing wrong with that as an intellectual exercise, but it hardly a full bore effort to understand economic reality. It's more an exercise in theory preservation, examining the kinds of rhetoric RE theorists might be able to use to defend the continued use of their favorite ideas. "Yes, if we use the word 'learning' in a very special way, we can say that RE theories are fully consistent with human learning!" Anyway, I've revisited this idea in my most recent Bloomberg column, which should appear this weekend. I find it quite irritating that lots of economists go on repeating this idea that the learning literature shows that it's OK to use RE when in fact it does nothing of the sort. You often find this kind of argument when economists smack down their critics, implying that those critics "just don't know the literature." In an interview from a few years ago, for example, Thomas Sargent suggested that criticism of excessive reliance on rationality in macroeconomics reflects "... either woeful ignorance or intentional disregard for what much of modern macroeconomics is about and what it has accomplished." On a more thoughtful note, Oxford economist Simon Wren-Lewis also recently defended the RE assumption (responding to a criticism by Lars Syll), mainly arguing that he hasn't seen any useful alternatives. He also refers to this allegedly deep learning literature as a source of wisdom, although he does acknowledge that it's aim has been fairly limited:

As I said above, Wren-Lewis is one of the more thoughtful defenders of RE, but he too here lapses into the use of "learning" without any qualification. More importantly, however, I'm not sure why Wren-Lewis thinks there is only a binary choice. After all, there is a huge range of alternatives between simple naive expectations and RE and this is precisely the range inhabited by real people. So why not look there? Why not actually look to the psychology literature on how people learn and use some ideas from that? Or, why not do some experiments and see how people form expectations in plausible economic environments, then build theories in that way?...If I really wanted to focus in detailon how expectations were formed and adjusted, I would look to the large mainstream literature on learning, to which Professor Syll does not refer. (Key figures in developing this literature included Tom Sargent, Albert Marcet, George Evans and Seppo Honkapohja: here is a nice interview involving three of them.) Macroeconomic ideas derived from rational expectations models should always be re-examined within realistic learning environments, as in this paper by Benhabib, Evans and Honkapohja for example. No doubt that literature may benefit from additional insights that behavioural economics and others can bring. However it is worth noting that a key organising device for much of the learning literature is the extent to which learning converges towards rational expectations.However most of the time macroeconomists want to focus on something else, and so we need a simpler framework. In practice that seems to me to involve a binary choice. Either we assume that agents are very naive, and adopt something very simple like adaptive expectations (inflation tomorrow will be based on current and past inflation), or we assume rational expectations. My suspicion is that heterodox economists, when they do practical macroeconomics, adopt the assumption that expectations are naive, if they exist at all (e.g. here). So I want to explain why, most of the time, this is the wrong choice. My argument here is similar but complementary to a recent piece by Mark Thoma on rational expectations.

This kind of work can and is being done. My Bloomberg column touches briefly on this really fascinating paper from earlier this year by economist Tiziana Assenza and colleagues. What they did, briefly, is to run experiments with volunteers who had to make predictions of inflation (and sometimes also the output gap) in a laboratory economy. The economy was simple: the volunteers' expectations fed into determining the economic future outcomes for inflation etc. by a simple low dimensional set of equations known perfectly to the experimenters, but NOT known by the volunteers. So the dynamics of the economy here were made artificially simple, and hence easier to learn than they would be in a real economy; but the volunteers weren't given any crutch to help them learn, such as full knowledge of the form of the equations. They had to, gasp, learn on their own! In a series of experiments, Assenza and colleagues then measured what happened in the economy -- did it settle into an equilibrium, did is oscillate, etc. -- and also could closely study how people formed expectations and whether their expectations converged to some homogeneous form or stayed heterogeneous. Did they eventually converge to rational expectations? Umm, NO.

From their conclusions:

In this paper we use laboratory experiments with human subjects to study individual expectations, their interactions and the aggregate behavior they co-create within a New Keynesian macroeconomic setup and we fit a heterogeneous expectations switching model to the experimental data. A novel feature of our experimental design is that realizations of aggregate variables depend on individual forecasts of two different variables, the output gap and inflation. We find that individuals tend to base their predictions on past observations, following simple forecasting heuristics, and individual learning takes the form of switching from one heuristic to another. We propose a simple model of evolutionary selection among forecasting rules based on past performance in order to explain individual forecasting behavior as well as the different aggregate outcomes observed in the laboratory experiments, namely convergence to some equilibrium level, persistent oscillatory behavior and oscillatory convergence. Our model is the first to describe aggregate behavior in a stylized macro economy as well as individual micro behavior of heterogeneous expectations about two different variables. A distinguishing feature of our heterogeneous expectations model is that evolutionary selection may lead to different dominating forecasting rules for different variables within the same economy, for example a weak trend following rule dominates inflation forecasting while adaptive expectations dominate output forecasting (see Figs. 9(c) and 9(d)). We also perform an exercise of empirical validation on the experimental data to test the model’s performance in terms of in-sample forecasting as well as out-of-sample predicting power. Our results show that the heterogeneous expectations model outperforms models with homogeneous expectations, including the rational expectations benchmark. [MB: In the paper they actually found that the RE benchmark provided the WORST fit of any of several possibilities considered.]

In the experiments, real learning behavior led to a range of interesting outcomes in this economy, including persistent oscillations in inflation and economic output without any equilibrium, or extended periods of recession driven by several distinct groups clinging to very different expectations of the future. Relaxing the assumption of rational expectations turns out not to be a minor thing at all. Include realistic learning behavior in your models, and you get a realistically complex economy that is very hard to predict and control, and subject to many kinds of natural instability.

One of the most important things here is that the best way to generate behavior like that observed in this experimental economy was in simulations in which agents formed their expectations through an evolutionary process, selecting from a set of heuristics and choosing whichever one happened to be working well in the recent past. This builds on earlier work of William Brock and Cars Hommes, the latter being one of the authors of the current paper. It also builds, of course, on the early work from the Santa Fe Institute on adaptive models of financial markets, which uses a similar modelling approach. So, here we do have an alternative to rational expectations, one that is both far more realistic in psychological terms, and also more realistic in generating the kinds of outcomes one sees in real experiments and real economies. Wonderful. Economists are no longer stuck with their RE straitjacket, but can readily begin exploring the kinds of things we should expect to see in economies where people act like real people (of course, a few economists are doing this, and Assenza and colleagues give some recent references in their paper). I think this kind of thing is much more deserving of being called a "learning literature." I don't know why it doesn't get more attention.