A booming US stock market doesn’t benefit all racial and ethnic groups equally

beSpacific 2025-04-15

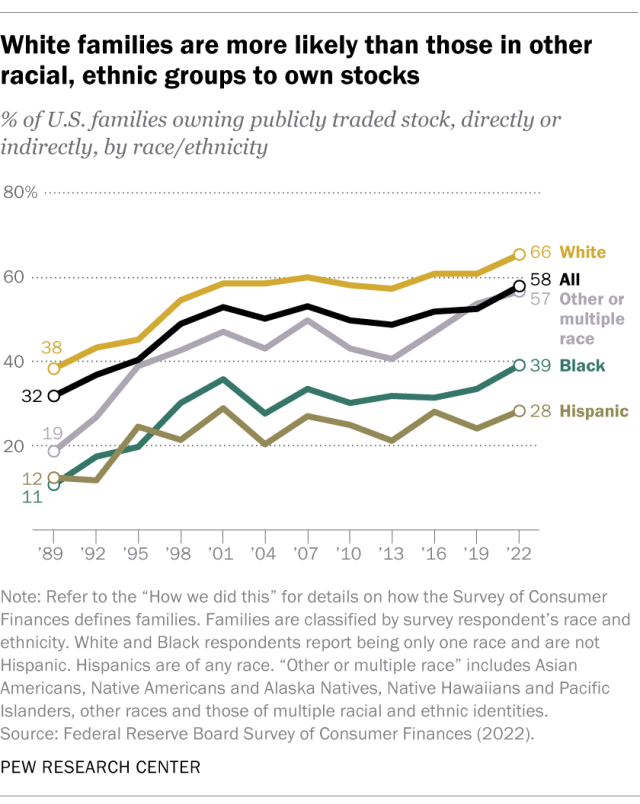

Pew Research Center: “U.S. stock markets have been on a roll since late October, with shares trading at or near record highs. But the booming markets are likely to benefit White families more than families from other racial and ethnic groups. That’s because White families are the most likely to own publicly traded stocks, either directly or indirectly – for example, through a retirement account or mutual fund. In 2022, nearly two-thirds of White families (66%) owned stocks directly or indirectly, compared with 39% of Black families and 28% of Hispanic families, according to the Federal Reserve’s Survey of Consumer Finances (SCF). And even when families of other racial and ethnic backgrounds own stock, they own a lot less than White families do. The median value of total stock holdings among White families in 2022 was $67,800, compared with $24,500 for Hispanic families and $16,500 for Black families. (The SCF includes limited data for Asian American families, discussed below, but not data on their stock holdings or ownership of other specific assets.) Similarly, the mean (or average) value of total stock holdings was $568,100 among White families, $97,400 for Hispanic families and $80,400 for Black families. The means are considerably higher than the medians because stock ownership is highly skewed. Most families own relatively little, but a few very wealthy families own quite a lot.”