Your post-Draghi carry trade

FT Alphaville » Euro 2014-06-09

Summary:

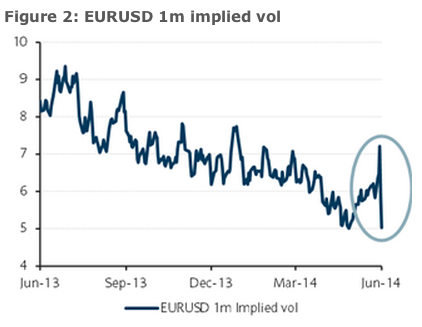

Ignoring the fact that the euro is acting more like a random walk model than usual, one seemingly obvious consequence of Draghi’s swarm attack is the euro’s growing attraction as as funding currency. As Barc said:

The structural selling of EUR vol post-meeting was the standout FX trade. We view this as further evidence that the current carry-supportive environment characterized by accommodative global monetary policy, historically low vol and strong equity market performance is likely to continue. It also supports our view that the EUR should be the funding currency of choice.

And from BoNYM’s Simon Derrick over the weekend:

Continue reading: Your post-Draghi carry trade