Friday lay day – Greek pension myths

Bill Mitchell - billy blog » Eurozone 2015-07-01

This is my Friday lay day blog where brevity is the aim. There was an article in the UK Guardian yesterday (May 21, 2015) – Fight to save the Greek pension takes centre stage in Brussels and Athens – which described the personal consequences of the pernicious austerity for recipients of state pensions in Greece. The State Pension system is one of the beachheads in the current struggle between Syriza and the Troika. The latter want further cuts to the entitlements provided to retirees as part of their demolition of living standards in Greece. The former are resisting but are on the path to oblivion given they will not be able to honour their electoral mandate to introduce stimulus policies while remaining in the Eurozone. But I was triggered to examine the latest data on pensions given the popular perception that Greeks get life too easy.

The UK Guardian article notes that:

Nearly 45% of Greece’s 2.5 million retirees now live on incomes of less than €665 a month – below the poverty line defined by the EU. Over half that number fell below the threshold at the start of the crisis in late 2009. Only a fraction of the 1.4 million people out of work receive unemployment benefits.

Which doesn’t sound like Shangri La to me.

The Government recently said that the pension was “the last social safety net preventing Greek society from completely falling apart. The elderly population is literally feeding the rest of the family.”

The Guardian then trots out the stereotyped line – “Few areas reflect the dysfunctionality of the Greek state more, or its inability to rein in budgets”.

They quote some LSE academic (political scientist) who worries about fiscal deficit and has long railed about the excessive generosity of the Greek pension scheme as saying that “Since the 1990s, successive governments have always subsidised the shortfall of pension funds for political reasons. That in turn has removed any kind of financial discipline from the system.”

Which is a curious comment because when the Greek government was sovereign, the notion that it “subsidises” a pension scheme for political reasons is nonsensical.

All spending is politically-motivated. But equally, all spending for a sovereign cannot be considered a subsidy because there are no financial constraints necessary so in what sense does the pension scheme have to ‘earn income’.

Quite stupid.

Each generation can choose the composition of government spending and the level of taxation it desires. So if the Greek pension scheme was generous that is to do with the political choices made and clearly if the population didn’t want people to have a reasonable retirement after a lifetime of work then they could alter the system.

By entering the Eurozone, the Greeks lost that sort of autonomy though and the Troika only see beans to be counted rather than people and tradition.

The UK Guardian article also notes that:

Greece spends more than any other EU member state on pensions. Close to 18% of national outlay was still being allocated at the height of the crisis in 2012.

Precisely because no other issue has put the perceived profligacy of Greeks into such focus, the tug of war between Athens and Berlin over pensions has been unusually vicious.

That comment motivated me to examine the data. So over to Eurostat did I go!

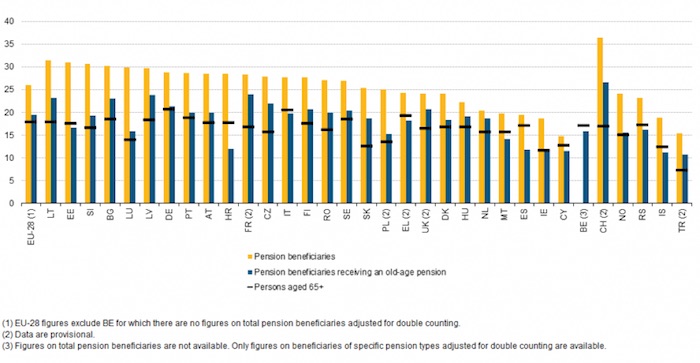

The latest data is up to 2012. First, the following graph shows the proportion of people in the total population that receive at least one pension in 2012 for Europe.

Greece is EL and it is not in the higher group, which include Germany, for example.

It is true that Greece devotes the highest proportion of its GDP to pension expenditure. But it is not far above Italy, France, Austria, Portugal, and Denmark.

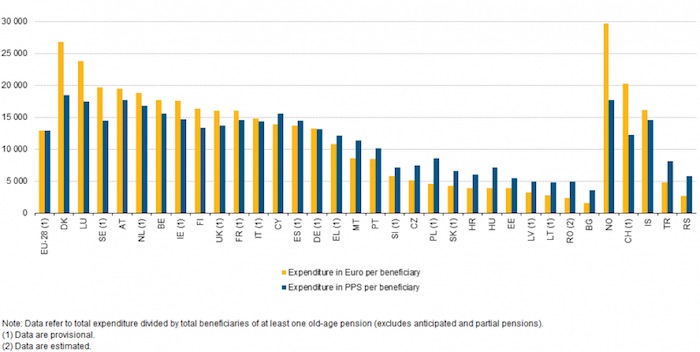

But it is hard to consider the total pension expenditure per beneficiary for old-age pensions to be overly generous in Greece. The following graph shows that statistic for the EU-28 as at 2012 (in euros).

There is Greece, in the middle of the pack, below Germany’s expenditure per beneficiary.

Clearly, this aggregate data can hide a raft of anomalies.

The Greek system favours earlier retirement than most. But then what is wrong with that? One could argue that forcing people to work into their dotage is anti-happiness and society would be much more productive and relaxed if people were encouraged earlier in life to explore their freedom from work.

The reality though is that the average age that Greeks go onto the old-age pension is 62.4 years whereas the comparable age for Germans is 63.2 years. So the claims that Greeks ditch work early, luxuriate on an inflated pension and then expect German workers to pay for that lifestyle choice via bailout payments is far fetched indeed.

Further, the real cost of running a state pension scheme is the real resources that the pension recipients consume once they stop working.

Under the Eurozone, with the emphasis on ‘counting beans’ (financial ratios) and mistaking the ‘beans’ as resource costs, clearly the concept of a real cost is lost and the conversation is about euros.

But had Greece retained is currency sovereignty the only issue of pension affordability would concern the availability of real resources to feed the pensioners. The government could fund such a system ad infinitum but could not necessarily guarantee it would retain the same standard of living in real terms over any particular period.

I don’t doubt that there are rorts and silly rules within the Greek pension system. Every nation can be accused of that – given that these systems evolve over decades and are the result of horse-trading between politicians.

But on the face of it, the data doesn’t reveal glaring differences between Greece and the rest of the EU.

And the UK Guardian article documents in a very personal way, the plight of the pensioner in Greece.

It always amazes me when the neo-liberal bean counters get started on people luxuriating on income support – whether they be the unemployed or old-age pensioners.

Then you dig a little and find these groups are living below the poverty line in many cases and suffer significant social exclusion and disadvantage as a result.

Then ask yourself the question – who would choose that sort of life?

Neo-liberal Australian Prime Minister becomes Marxian

Chapter 6 of Karl Marx’s Capital Volume I discusses the – The Buying and Selling of Labour-Power. It is a key chapter given that the identification of the difference between the commodity labour power, which the worker is forced to sell in the market to make a living and the service that flows from the commodity, labour, is central to understanding how surplus value is created, yet obfuscated under the capitalist mode of production.

“Money bags” (as Marx referred to the capitalist) “regards the labour-market as a branch of the general market for commodities” and is only interested in extracting as much use value from the labour power that he/she purchases.

As Marx notes:

One consequence of the peculiar nature of labour-power as a commodity is, that its use-value does not, on the conclusion of the contract between the buyer and seller, immediately pass into the hands of the former.

That is, the capitalist has to extract the services and thus has to set up control processes to ensure surplus labour is performed.

But in the process of exchange, capitalism was different to feudalism (or slavery) because the the owner of labour-power was free to contract with whoever they chose, although they had to contract with someone given the lack of access to the means of production.

However, as Marx noted, one the commodity exchange occurs (labour power for wage):

… we can perceive a change in the physiognomy of our dramatis personae. He, who before was the money-owner, now strides in front as capitalist; the possessor of labour-power follows as his labourer. The one with an air of importance, smirking, intent on business; the other, timid and holding back, like one who is bringing his own hide to market and has nothing to expect but — a hiding.

What has this to do with Tony Abbott, the Prime Minister of Australia. Well, on Wednesday of this week, the Prime Minister was outlining the new policy with respect to the long-term unemployed to an audience at the Queensland Chamber of Commerce.

Essentially, the government is proposing to provide unemployed workers to firms for up to four weeks at a time for zero cost to the private employer. The unemployed would be required to work and would receive the income support payment if they did.

Under 30s, would have to work for 25 hours, while those between 30 and 49 years of age would have to work 15 hours a week.

The single unemployment benefit is $519.20 per fortnight (or $37 a day per 7-day week), which is well below the current poverty line. Younger workers would be forced to work under the scheme at below the legally minimum wage.

So the bosses get the workers for free and the unemployed are kept in poverty and forced to work for below legal rates.

The Prime Minister’s take on the scheme was that for employers:

It gives you a chance to have a kind of ‘try before you buy’ look at unemployed people.

You know, just like when you go to the fruit shop and pick and choose or get a free sample of some commodity.

In a radio interview next day the interviewer confronted the Prime Minister with “These are people, not a pair of shoes”.

Abbott replied that he might have breached the “canons of sensitivities”.

But this is the recognition that the labour power of workers is a commodity.

Music from the past

This morning as I worked I was listening to – Lou Donaldson – and his band. This track – Bag of Jewels – is from the – Midnight Creeper – album released March 1968.

The band was Lou Donaldson on alto saxophone, Blue Mitchell on cornet, Dr. Lonnie Smith on Hammond organ, George Benson on guitar, before he virtually abandoned the instrument and attempted to convince us that he could sing, and Idris Muhammad on drums.

The track was written by Lonnie Smith. George Benson shines.

Lou Donaldson is credited with introducing funk to the music scene before Parliament and James Brown (for example). He developed an “organ-sax groove sound” while relentlessly touring the US which many considered to be the precursor of funk.

Donaldson preferred to call the groove “swinging bebop” and said “Funk is James Brown and Earth, Wind and Fire, and I’m not about either one”.

If you want to know more about Lou Donaldson there is an excellent three part interview from 2010 available – Part 1 – kicks it off.

One of my favourite bands.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.