The European circus continues

Bill Mitchell - billy blog » Eurozone 2016-02-23

Yesterday, I briefly examined how a pack of big-noting financial market traders were trapped in stupidity by patterned behaviour and self-reinforcing group dynamics (aka Groupthink). Today, we consider the neo-liberal Groupthink that continues to trap political leaders and policy makers in Europe into a web of denial and stupidity. In both case, innocent people have suffered huge negative impacts while, by and large, the idiots have escaped fairly unscathed. The recent data from Eurostat shows that growth is fairly flat in the Eurozone and industrial production is in recession. It also shows that the banking system is in deep jeopardy and the so-called reforms that were introduced post-GFC are not considered robust by investors. With massive bank deposit flight going on and banking share prices plunging, it is clear that the ‘markets’ have lost faith in the financial viability of the Eurozone. Meanwhile. Mario Draghi winds the key up in his back and tells the world that everything is fine and the ECB is on top of the situation. With chaos descending on the monetary union again, the ECB cannot even achieve its single purpose – a stable 2 per cent inflation rate. It has failed to even achieve that over the last four years. One couldn’t write this sort of stuff if they were trying.

On Monday, February 15, 2016, the President of the ECB, Mario Draghi appeared before the Economic and Monetary Affairs Committee (ECON) of the European Parliament.

In his – Introductory statement by Mario Draghi, President of the ECB – he said:

The recovery is progressing at a moderate pace, supported mainly by our monetary policy measures and their favourable impact on financial conditions as well as the low price of energy. Investment remains weak, as heightened uncertainties regarding the global economy and broader geopolitical risks are weighing on investor sentiment. Moreover, the construction sector has so far not recovered.

It seemed to escape him that both investment (capital formation) and construction are likely to be the most sensitive of the spending components to interest rate movements (if at all) and despite all the misconceptions about European monetary policy at present, effectively all the ECB is doing is keeping interest rates low.

Note also his use of the word “moderate” whereas the most recent national accounts data released by Eurostat on Friday (February 12, 2016) might better describe a record of economic performance as parlous if not appalling.

In the data release – GDP up by 0.3% in both euro area and EU28 – we learn that Greece and Finland are wallowing in recession

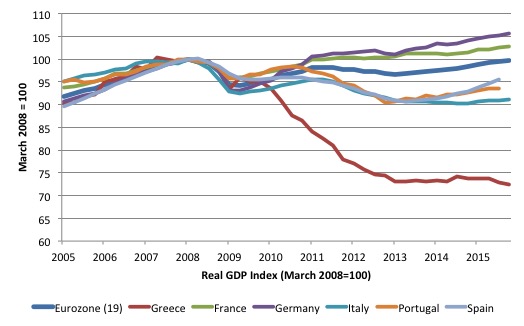

The following graph shows real GDP indexes for the Eurozone (19) nations, and some selected Member States from the March-quarter 2008 until the December-quarter 2015. Note, that Eurostat did not provide December-quarter data for Spain and Portugal.

What we learn is that the Eurozone as a whole has still not reached the real GDP level achieved at the peak (March-quarter 2008) before the crisis. That is 32 quarters have elapsed and the monetary union is still not back to where the levels of production when the crisis began. That is eight years.

The Greek economy is now 27.6 per cent smaller than what it was in the March-quarter 2008. It continues to deteriorate.

Austerity ‘poster child’ Spain was still 4.5 per cent smaller than what it was at the onset of the crisis (as at the September-quarter). Italy is 8.9% smaller. Portugal was 6.5 per cent smaller (as at September-quarter).

Even those with above-average Eurozone growth are not performing very well themselves. For example, Eurozone leader Germany is only 5.5 per cent larger than it was in March-quarter 2008, while France is only 2.7 per cent larger.

How anyone could construct this sort of data as being in any way reflective of sound policy design is beyond any reasonable imagination.

An accompanying data release from Eurostat (February 12, 2016) – Industrial production down by 1.0% in both euro area and EU28 – tells us that:

In December 2015 compared with November 2015, seasonally adjusted industrial production fell by 1.0% in both the euro area (EA19) and the EU28 … In November 2015 industrial production fell by 0.5% in both zones.

So, in terms of industrial production the Eurozone and the European Union, in general, is now in recession, given the two consecutive periods of negative growth. I also note the decline in November percent terms doubled in December 2015.

German industrial production fell by 1.3 per cent in December 2015, Ireland by 4.3 per cent, Spain by 0.2 per cent, France by 1.7 per cent, and Italy by 0.7 per cent to list a few of the nations. The ‘austerity darlings’ Estonia, Latvia and Lithuania declined by 2.9 per cent, 1.2 per cent and 3.3 per cent, respectively.

This is Mario Draghi’s conception of “moderate” growth!

The Eurozone remains a catastrophe because its intrinsic design is deeply flawed and the band-aids that have been put in place on an ad hoc basis since the crisis cannot hide that fact.

Think about the – American Recovery and Reinvestment Act of 2009 – which was President Obama’s fiscal stimulus program introduced on February 17, 2009.

There was massive criticism of the program, some of it justified. But the plan was to “save and create jobs almost immediately” and was a mixture of tax incentives and federal spending.

One of the problems of the package was that it was too small. The US fiscal deficit should have risen by a few percentage points of GDP more than it did to really combat the crisis.

But having said that the evaluations of the program suggest that it promoted an increase in GDP (Source) of around 0.4 to 1.4 per cent in 2009, 0.7 per cent to 4.1 per cent in 2010, 0.3 to 2.2 per cent in 2011 and 0.1 to 0.8 per cent in 2012.

The declining contribution reflects the time profile of the stimulus package which really provided a bost in 2010 and then was withdrawn steadily after that.

Even a majority of mainstream economists agreed that the stimulus was successful. The IGM Forum polling (released June 29, 2014) – Economic Stimulus (revisited) – was a followup poll on an early poll conducted on February 15, 2012.

When asked whether “the U.S. unemployment rate was lower at the end of 2010 than it would have been without the stimulus bill”, 82 per cent agreed overall (with 39 per cent strongly agreeing).

56 per cent agreed that the benefits of the program outweighed any costs.

Over the last six years, the ECB has bent over backwards with various forms of quantitative easing, low interest loans to banks, and other so-called ‘monetary loosening’ policy initiatives.

I wrote about the effectiveness of some of these measures in this recent blog – The ECB could stand on its head and not have much impact.

Even though the cost of borrowing in the Eurozone has fallen quite substantially since 2008, total loans to households and non-financial institutions remain stagnant.

It is clear that the malaise in Europe has not yet lifted: firms are reluctant to invest (and hence borrow) because of slow sales, while households have also been subdued in their borrowing given the elevated and persistent levels of mass unemployment, the hangover of the credit binge (that is too much debt already), and the general policy uncertainty where Brussels appears not to have a clue as to which way to turn.

If monetary policy was truly effective as a stimulating measure then Europe would not have fallen so far behind the US in terms of real GDP growth since the crisis.

The fact that the Eurozone as a whole is still operating at levels below the March-quarter 2008 levels reflects both the ineffectiveness of monetary policy and the diabolical suppression of the capacity of fiscal policy to stimulate growth, as was evidenced in the US (as above) and other nations such as Australia.

In Australia, the fiscal stimulus introduced in late 2008, early 2009 was substantial and saved the economy from entering a recession. It was estimated to have contributed strongly to the recovery in the evaluation reports, which also said that the impact of the Reserve Bank interest rate cuts and support to the commercial banks (loan guarantee) was inconsequential in relative terms to the fiscal policy impact.

The only thing that the ECB claims is its charter is to hit an inflation target of 2 per cent per annum. The data tells us that it has failed to even achieve that aim for the last four years much less stimulate any reasonable recovery.

Further, the so-called banking reforms and the touted creation of the ‘Banking Union’ are farcical.

You might want to read this recent evaluation of the banking union fiasco by Thomas Fazi – EU Banking Union: Recipe For Renewed Disaster.

The bottom line is that they have managed to come up with another flawed plan – a typical European ‘compromise’ that Germany crafts to suit its own austerity obsessions – where they have set up joint supervision and resolution but no resources for the Member States to defend their own banks (that is, no central guarantees) and no system of deposit insurance.

Who would deposit their savings in any Eurozone bank? The evidence is clear – there is a massive movement in deposits from south to north at present as people seek what they think of as safer havens.

They haven’t really understood the Deutsche Bank issue but they will!

The deposit flight is also being motivated by the negative interest rates, which means that the smaller banks which do not speculate in derivative products but provide loans to the common folk, are now finding their ‘business model’ to be unworkable.

The European banking system is teetering on the edge. There are heaps of zombie banks still trading. Italy’s banks are carrying a massive exposure to bad loans and the stiatuion is getting worse. It is no wonder their share values have declined by around 30 per cent since the start of 2016.

The geniuses in Brussels and Frankfurt have come up with a new derivative product – the so-called “contingent convertible bonds” or cocos which were meant to be a buffer if a bank collapsed. It is another ticking time bomb!

But the problem is that once any bank hits the wall the cocos become equity and they disappear as the joint resolution mechansim (the ‘bail-in’ system) wipes off the equity (the ‘bondholders’ of the bank).

A brief comment on the Deutsche Bank issue. I note that the German Finance Minister Wolfgang Schäuble has recently said that the “volatile Portuguese bond market is more alarming than plunging confidence in Deutsche Bank”.

The Bloomberg article (February 13, 2016) – Schaeuble Says Portugal Debt Woes Trump `Strong’ Deutsche Bank – reported that Schäuble claimed the bank “has sufficient capital and is well positioned”.

We will see.

The article also quoted European Economics Commissioner Pierre Moscovici as saying “We can see that the European banking system is much more solid than in the past. We have to have confidence in it”.

While it may just be a translation issue, the “have to have” sounds like a desperate plea rather than a view based upon solid ground. Certainly, the banking union reforms hardly change the situation that Europe was in at the onset of the crisis.

But, the ECB still claims it is “ready to do its part” as Mario Draghi told the European Parliament yesterday.

He also said that:

… in the light of the recent financial turmoil, we will analyse the state of transmission of our monetary impulses by the financial system and in particular by banks. If either of these two factors entail downward risks to price stability, we will not hesitate to act.

The problem is that the only action that would make sense in the current situation would be for the ECB to announce that it was prepared to buy any debt issued by any Member State in the secondary markets that day after issue.

They could dress this up in the same way that they have been dressing up the SMP and subsequent bond-buying exercises – that is, as part of its normal liquidity management. While ridiculous, this narrative appears to fool Brussels into thinking that the Treaties are not being violated – or rather, like all things associated with the European elites, they turn their back when things get a bit uncomfortable. They have a long history of doing that.

The Member States could then appeal to special circumstances under the Stability and Growth Pact, which allows fiscal deficits to exceed the three per cent threshold. They could then expand their deficits, substantially in most cases, by introducing direct employment creation and public infrastructure expenditure.

The private bond markets would buy up all the debt and sell it next day to the ECB. More or less anyway.

Economic growth would accelerate and unemployment would drop immediately.

That would be consistent with doing ‘anything that is required’.

The problem is that the ECB will not do that and will, instead, make grandiose claims about the effectiveness of negative interest rates, low interest rate loans to banks, and its quantitative easing program.

Meanwhile, the malaise will continue.

Conclusion

And with all that, many in Britain still think staying in this dysfunctional mess which is slowly disintegrating is a desirable outcome.

Brexit, as it is being called, is the only outcome for Britain, which makes sense.

All the concessions that Brussels are making to Britain just to keep it inside are, in fact, working in the opposite direction of where they have to go to start making the common currency work. More Europe not less is the direction they should traverse, although Germany will never let the Member States go there.

Advertising: Special Discount available for my book to my blog readers

My new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is now published by Edward Elgar UK and available for sale.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Some relevant links to further information and availability:

1. Edward Elgar Catalogue Page

2. Chapter 1 – for free.

3. Hard Back format – at Edward Elgar’s On-line Shop.

4. eBook format – at Google’s Store.

My latest book – Eurozone Dystopia Groupthink and Denial on a Grand Scale – available in much cheaper paperback form from July 2016. http://www.e-elgar.com/shop/eurozone-dystopia?___website=us_warehouse

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.