Disingenuous at best

Bill Mitchell - billy blog » Eurozone 2013-09-19

In light of the – An Open Letter from Howard Schultz, ceo of Starbucks Coffee Company – which contains “a respectful request that customers no longer bring firearms into our stores or outdoor seating areas”, I felt it necessary to request that all readers of my blog leave all weapons (guns, rocket launchers and any other armaments that you carry on a regular basis) away from their side when they read my blog. Otherwise, violence might erupt as the arrogance of the neo-liberals scales new heights – five years into the crisis. To get your ire up several notches, you might read the latest article (September 16, 2013) by Greg Palast – Larry Summers: Goldman Sacked (thanks Gustavo). Remember keep your weapons out of reach! Then you might reflect (keeping as calm as you can) on the latest offering from the German Finance Minister, Wolfgang Schäuble in the Financial Times (September 16, 2013) – Ignore the doomsayers: Europe is being fixed. The triumphalism throughout the article demonstrates to me that Mr Schäuble has standards of excellence that lie well below what is conventionally considered to be (barely) reasonable. What he uses as the benchmark for defining mediocrity is beyond imagination. These are crazy times – when these economic criminals walk the streets at large, puffed up by their own arrogance and delusion, slapping themselves and their mates on the back, demanding credit for the human wreckage that their actions created, made worse and ensured will span generations. While we see youth unemployment rates of 62.5 per cent and rising suicide rates, these characters see glory and fulfillment. A most strange period of history and future generations will reflect on these apes poorly. Most of the ideas that underpin the perspectives that are reflected in this article by the German Finance Minister come from my profession, which is typically occupied by well-paid individuals in secure employment who have substantial pensions to look forward to when they retire.

They wax lyrical about the world they construct in the comfortable and well appointed offices as if they were saying something about the real-world that lies beyond the campus boundary. This mythical text world we are continually being assaulted with by economists bears no relation to the world where workers strive to make ends meet and bosses manipulate workplaces to their advantage.

Interventions into the public debate from mainstream economists since the onset of the crisis has been disingenuous at best. The startling way in which mainstream economists, whose public statements helped create the crisis in the first place, have resumed their position in the public about is testimony to the way in which degenerating paradigms maintained their hegemony.

Among other tactics used, is the diversion – which involves redefining the problem that we all see into a non-problem that only they can see. For example, what was obviously a private debt crisis has been reconstructed as a sovereign debt crisis, which conveniently allows them to continue the pursuance of their anti-government policy biases.

What is obviously a problem of mass unemployment as a result of a collapse in employment growth has been reconstructed as a juxtaposition between skivers and triers. Those lazy bastard unemployed – if only they would get off their lazy butts and get a job and get off the welfare.

I know! If we cut welfare payments that obviously subsidise this idle pursuit of leisure that will force those lazy unemployed bastards to do something for themselves! Yes it will – their kids will become malnourished, their marriages will collapse and they will increasingly enter the nether world of alcohol and substance abuse and mental illness as they descend further into poverty.

That sort of thing.

Disingenuous at best. Criminal not far after that. Crimes against humanity.

Take your pick on the meaning – they all apply.

The article by the German Finance Minister is in that vein.

My comments follow directly from the brief analysis I presented in yesterday’s blog – Eurozone nowhere near creating a truly federal structure

Remember this:

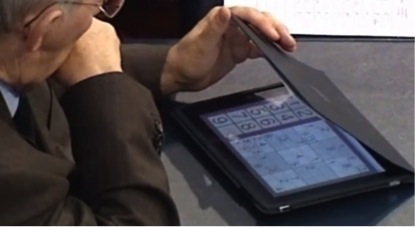

The German Finance Minister was caught by German TV station ARD playing Sudoku during an important debate in the Bundestag about the first Greek bailout.

The German government ordered ARD to delete all material relating to this incident from its WWW-site. You can see the YouTube video of a very sneaky finance minister – HERE

Please read my blog – Athens burned, while I played Sudoku – for more discussion on this point.

But now, he has generously taken a break from the game to tell us how well the Eurozone is doing and how right he and his German iron booted mates – or we should use his words – “cool-heads” – have been.

The rest of us – who each day for the last five years have been witnessing an unfolding human disaster – have according to the Finance Minister been operating out of our analytical depth – bemused and angry (that Europe is a success story), and have missed all the progress the “cool-heads” were making and have been ignorant of the “ambitious”, “flexible and adaptive” strategy that has been put in place by those Masters.

If only we had heeded the lessons from the marvelously successful German reforms, which started in 2003, we would not have been so plainly stupid to think a youth unemployment rate of 62.5 per cent was anything to worry about. Just a bit of flexible and adaptive structural reform.

The triumphalism in Wolfgang Schäuble’s prose is something else.

He writes:

The world should rejoice at the positive economic signals the eurozone is sending almost continuously these days. While the crisis continues to reverberate, the eurozone is clearly on the mend both structurally and cyclically.

What is happening turns out to be pretty much what the proponents of Europe’s cool-headed crisis management predicted. The fiscal and structural repair work is paying off, laying the foundations for sustainable growth. This has taken critical observers aback. It should not have, because, in truth, we have seen it all before, many times and in many places. Despite what the critics of the European crisis management would have us believe, we live in the real world, not in a parallel universe where well-established economic principles no longer apply.

Yes, just in the last few weeks we learned from – Eurostat – that:

1. Employment continues to decline – Document.

2. Industrial production fell over the last quarter and year – Document.

3. Labour Costs slowed because employment has plummetted so much – Document

4. Unemployment continues to rise – Document.

I know, lagging indicators. Of-course unemployment continues to rise in the recovery as participation rates rise because employment growth attracts the discouraged workers back into the labour force.

The only problem is that the employment growth remains negative and the employment-population ratio has fallen in the EU28 from 70.3 per cent in 2008 to 68.4 per cent in 2012 (and will be lower yet again in 2013).

Mr Schäuble tells us to “Take Germany” as an example of the success the “cool-heads” have created:

In the late 1990s it was the undisputed “sick man” of Europe … A first wave of adjustment, starting in 2003, focused on strengthening employment incentives, streamlining the public sector, fixing social security and raising consumption taxes. Down to shop-floor level, companies and unions worked together to make labour more flexible. A second wave of expenditure restraint and reforms followed once the financial crisis was past its peak.

I have written about these so-called reforms before.

Please read my blog – 72% youth unemployment – the crowning glory of the neo-liberal infestation and Eurozone production and employment still going backwards – for more discussion on the Hartz reforms.

The so-called mini-jobs have been such a wonderful innovation for German workers – cutting pay, job security and starving the German economy of the wherewithal to maintain robust domestic demand.

So what?

German real GDP growth was fairly poor in the period leading up to the crisis and was driven by its low-wage export-led approach which stifled domestic demand and relied on large current account deficits in its neighbours.

The so-called “over-spending” of nations such as Greece were just a mirror image of the underspending by German workers. The underspending was the direct result of the move to labour market deregulation and the shift in real income away from wages towards profits that followed.

If all nations are to be deprived of the capacity to maintain reasonable rates of growth in domestic demand, the German economy will go into recession because for every dollar of export revenue there has to be a dollar of import spending.

The German (low) growth model that, in part, caused the crisis to impact most severely on the peripheral economies, is an unsustainable way to generate stable growth and low unemployment.

By reforming – read destroying – the capacity of economies to maintain adequate real GDP growth rates, the so-called cool-heads are also undermining the German growth strategy.

Mr Schäuble then claims the problems with several Eurozone nations is that they have:

… let labour grow expensive and their share of world trade shrink. As the bust came, jobs vanished and public finances deteriorated.

There would have been no major crisis in Greece or Spain had their governments not signed away their currency sovereignty and agreed to operate under a fixed exchange rate system.

Their economies may be unbalanced with low productivity but when the crisis hit their exchange rates would have fallen thus reducing any non-competitiveness, the real wages of workers would have been reduced in terms of imported goods and services, and redirection of spending would have occurred to bias domestic production.

Their governments would have been able to privilege domestic expansion without the ridiculous fiscal rules embodied in the German-inspired Stability and Growth Pact. The bond markets would not have dealt with them severely because the “boot would have been on the other foot” – that is, the markets would know that the governments could spend without doling out the corporate welfare in the form of government debt.

And that would have been that. We would not have seen unemployment rates in Greece rising from the pre-crisis 8.7 per cent to nearly 30 per cent by the end of 2013. Or in Spain already at 28 per cent. We would not have seen youth unemployment rates topping 60 per cent, which condemn that cohort to a life of disadvantage and despair.

Mr Schäuble claims the:

European safety nets have provided a well-calibrated mix of incentives and solidarity to cushion the pain.

Read: starvation has been prevented in many cases.

What are his estimates of the costs of the massive youth unemployment? No cost-benefit or cost-effectiveness studies have been published by the EU or EC on the costs of the austerity. They will be massive and span generations.

Mr Schäuble blames “dysfunctional labour markets” in Southern Europe for the mass unemployment. He apparently has an elaborate insight in some major structural change that occurred between 2008 and 2010 to explain the massive increase in unemployment in these nations.

What could that structural change be? Why did these dysfunctional markets suddenly stop producing employment? No response or insight is every provided that can substantiate that thesis.

The fact is that real GDP collapsed and that kills jobs growth. Before the crisis, employment growth in the Southern nations was sufficient to keep unemployment from rising.

The Greek economy has already shrunk by around 25 per cent with another 5 per cent coming this year. This has nothing to do with dysfunctional labour markets.

Spending equals income equals output which generates jobs.

Conclusion

I have run out of time today but Mr Schäuble’s message of triumph says that we shouldn’t get too worried about the bad times but look to the future:

… however bad the times, we should fight the human tendency to extrapolate the present forever into the future. Systems adapt, downturns bottom out, trends turn. In other words, what is broken can be repaired. Europe today is the proof.

Growth will return as it always does. But the detritus in this case will be massive and largely unnecessary.

Further, the real policy changes that are required to prevent the Eurozone from melting down when the next negative spending shock arrives have not been implemented.

Competitiveness is barely changed. There is no coherent federal structure in place to give legitimacy to the monetary union. All that has been achieved is that forced poverty in many states has battened the situation down for a while – his claim that current account deficits are converging. Yes, because import demand has collapsed as national incomes have collapsed.

There has been very little increased capacity in Europe created to handle what happens if growth does resume – what will happen to these current account balances then?

But also when the negative shock comes next – the whole ball game starts again – but this time from a much lower base than before.

You may also like to read the normally conservative UK Telegraph journalist Ambrose Pritchard-Evans on our Sud -playing German – My grovelling apology to Herr Schäuble. That might calm you down a bit. I thought it was a cleverly crafted response.

Moron Watch!

The new conservative Australian government today (2 days after it took office) closed the Federal Climate Commission “which had been established to provide public information on the effects of and potential solutions to global warming”.

The ABC story – Abbott shuts down Climate Commission – noted that the closure was a saving to government but despite the erroneous logic surrounding that claim, the fact is that the new Government are climate change deniers – a.k.a. morons.

This is one of many moronic acts that the Government will take as it tries to take us back to the past – where the elites could swagger around doing what they wanted and who cares about the rest.

And at the state level, the ABC reported today the NSW Government was banning hopscotch courts being drawn by children on pavements. The article – NSW graffiti laws to also outlaw hopscotch squares – tells us that police can arrest children for chalking out a court to have some fun.

But reading between the lines – the anti-gay conservatives have been hating the surge in – rainbow crossings – being drawn across our roads, after the first one emerged in Oxford Street, Sydney in April 2013.

The law is most likely targetted at punishing anyone who has the creativity, skill and temerity to draw a lovely coloured crossing across any of our streets.

The bans are moronic – but Australia is now firmly under the political grip of these climate-change denying, anti-gay conservatives. Stay tuned for the attack on the unemployed, single mothers, pensioners on disability support, indigenous Australians and other persons who are at the bottom of the pile in our society. The conservative assault on these groups will just build on the disgusting way the Labor Party dealt with them anyway.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.