Mirror Trading International's Cornelius Johannes Steynberg and his $3.4 Billion USD Default Judgement

CyberCrime & Doing Time 2023-05-03

Some of you may have heard that students in UAB's Investigating Online Crimes class have been researching Crypto Investment Scam websites. You can find a list of some of the sites we've identified so far on URLScan.io using our tag "CryptoScam" (as of this writing we have 3600+ sites on the list -- hosting companies and registrars, please take action!)

Mirror Trading International and a $3.4 Billion Fine

I'm proud to say that this action was brought in part by the Alabama Securities Commission, who joined Texas, North Carolina, and Mississippi in taking action. I've met their director (who just retired this week! Thank you Joe Borg for 30 years of service!) and some of their investigators and they fight hard to protect the citizens of Alabama from fraud.

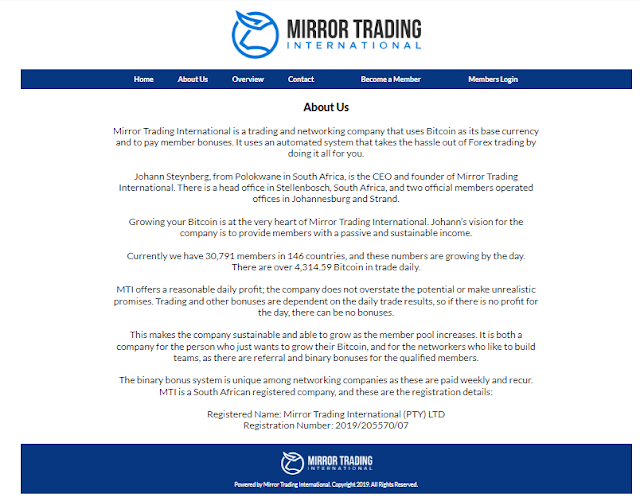

Mirror Trading International claimed that their members could earn 10% per month in interest on their investments. A typical ad of theirs boasted of this advantage over traditional bank accounts and other investment vehicles:

Ponzi Scam or Affiliate Program: Tomato / Tomato

South Africa's Court Order Outlines a Problem: Greed

Scammers or Victims: Why Not Both?

Steynberg Arrested in Brazil

Assurances from MTI CEO Steynberg: I am not a Ponzi Scheme!

When Mirror Trading was first accused of being a Ponzi Scheme by the Texas Securities Commission, their CEO replied to queries using a form letter like this one, shared by Global Crypto in a story called "MTI Announces It Is Working With the FSCA":Dear Kratika,

I unfortunately only received your email this morning, Tuesday 14 July 2020.

As I have declared to the Texas Commissioner in writing, I wish to state and declare from the outset that Mirror Trading International (Pty) Ltd (hereinafter referred to as “MTI”), a privately held company registered in the Republic of South Africa, is not a Ponzi scheme (new money feeding old) or a scam, with which a holder of funds suddenly disappears.

It is also most unfortunate that because MTI is operating in the online passive income building industry, which has a notorious and demonstrated reputation for scams and Ponzi schemes, and, due to the nature and Modus-Operandi of the robust MTI referral-based business model, that MTI is automatically by default behaviour of the media and some regulators, and maybe the behaviours of some members, is being perceived by associative conclusion that MTI is but another of these.

This unfortunate and misinformed perception is far from the reality of what MTI is as a newly formed (15 month old) highly innovative referral-business and brand that the founders would like to see growing over many years into a global, iconic and heritage brand in the market trading sector.

For instance, the Texas Commissions states that …The actual value of the commissions depends on their success in recruiting new investors and multilevel marketers. … While this may apply to Ponzi schemes, this is not correct for MTI.

Daily trading returns using top regulated trading brokers determine the quantum of rewards, which can vary and if there is a negative trading day, there are no rewards. The point is that with MTI, that the funding of MTI referral payments is derived from daily trading profits and not from the funds of new members.

Another important point which differentiates MTI from Ponzi’s and scams is that members have full control over their funds (Bitcoin) at all times. Members are able to add or withdraw their funds (Bitcoin) at any time, with no complications and no fees. If you do research, you will find not a single member of the 75,000+ MTI members worldwide has ever complained or not been able to withdraw their BTC whenever they have opted to.

It is the aim of MTI and its innovative, unique referral-based business model and MTI’s operating Modus Operandi of trading on world markets to generate real growth and returns on a daily basis, to work with and co-operate with regulators in every regard, in the process of taking MTI along a path that will see MTI fully and properly regulated. There are three reasons for this.

1. My Founding Vision for MTI: Build a preferred iconic and heritage global brand in the financial services sector that delivers sustainable growth and value creation for all stakeholders, including for the little man in the street: 2. Professional and Compliant: Ensure that MTI is a professionally managed business and brand that is regulatory compliant and which delivers sustainable growth and value creation for all stakeholders. My team and I are committed to this. 3. Change the reputation of the on-line passive income generating industry: We and myself personally, are extremely tired of this industry having a negative and darkly clouded reputation. And yes, some 99.9% of online passive income building services are scams and / or Ponzi’s. I am personally very driven to be part of changing this perception once and for all, by showing and demonstrating to regulators, to the media and to consumers that such a business model can on a Bona Fida basis, exist, successfully operate and grow on an organic and sustainable basis, which is what MTI is doing.

To this end, MTI will in the coming period be placing great emphasis on engaging with and working with any regulator with a clear purpose at all times; be fully compliant as a professionally managed company and brand that delivers sustainable growth and value creation to its stakeholders, and which intends to be around for many years to come.

MTI is already in discussion with the South Africa Financial Services Conduct Authority (FSCA) and will be meeting with the FSCA in a week’s time. MTI is also fully committed to co-operating with the Texas State Securities board and is in correspondence with them on this matter.

We trust that the above gives you some insight into MTI.

Should you wish to correspond further, please use my private email address: [REDACTED] Your sincerely,

Johann Steynberg Chief Executive Officer Mirror Trading International (Pty) Ltd South Africa